Archive for the ‘Industry’ Category

Tuesday, August 20th, 2013

It should come as no surprise to readers of this space that 2013 is on track to set a sales record, with well over $9 billion in sales being transacted; to date, the city has seen nearly $7 billion in real estate changing hands. Resale prices are up, and people are still buying, thanks to some very solid employment numbers (we’re one of the country’s only bright points on that front), relative affordability (especially in the condo market), forced moves due to the flood, and just the general appeal of our city to people from all over. Calgary’s a place where you can get a good job and raise a family without too much fear of the bottom falling out of your lifestyle.

So, of course, there’s gotta be the end times coming, and naysayers point to a slowdown in the purchase of land for new properties to show that they’re almost here. Call me optimistic, but I just don’t buy that as proof that we’re in a bubble about to burst. Developers have bought up huge swaths of land recently to keep up with the demand in our hot seller’s market, but they still recognize that the country’s fragile economy will likely lead to some ebbs and flows. So the houses get built, they sell, then new rounds of purchasing can begin. While suggestions that land purchases have dropped more than 50 percent in Calgary year-over-year may sound alarming, the other way to look at that is there was a lot of land bought up last year that’s becoming homes sold this year.

Real estate markets cycle, they don’t generally boom and bust without outside factors manipulating them (as was the case in the US some years ago). So, as I seem to say often around here, take the alarmist news with a healthy dose of skepticism.

Tags: boom time, calgary alberta real estate, calgary real estate, calgary real estate market, calgary real estate resale, calgary real estate statistics, real estate boom, Real Estate Forecasting, real estate market, real estate records, real estate trends

Posted in Forecasts, Industry, Statistics | Comments Off on Boom and Slightly Less Boom

Wednesday, August 14th, 2013

Thanks to the busier than expected real estate market this year, CMHC – the government-backed outfit that offers insurance against mortgages when down payments of less than 20 percent are made – has already reached three-quarters of its cap for the year. The government had allowed for up to $85 billion in mortgage-backed securities to be issued in 2013, and we’ve already hit nearly $64 billion.

What does this mean? Well, the government will want to cool down the market a bit by implementing new rules that make it more difficult to qualify for a mortgage. Further, fixed rates on mortgages will likely be going up, with jumps of between 0.2 percent and 0.65 percent by the fall.

It’s going to become harder to be a pre-approved buyer, which means those who have pre-approval will become highly valued by sellers. Really, that’s one of the first things you should do if you’re entering the real estate market: get pre-approved, so you know what you’re working with and the seller knows you’re serious.

None of this is especially surprising or dire, but it’s well worth being aware of. As more develops, I’ll keep you posted

Tags: alberta real estate, calgary real estate, canadian mortgage, canadian real estate, CMHC, fixed-rate mortgage, mortgage insurance, mortgage pre-approval, mortgage rate, real estate market

Posted in Industry, News | Comments Off on CMHC Nearing Its Annual Cap

Tuesday, July 30th, 2013

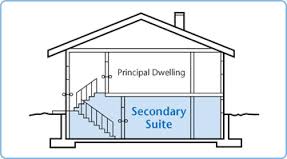

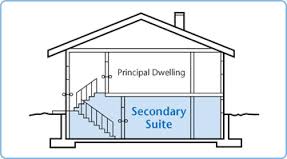

The impact to the city from last month’s flooding continues to make itself felt, aggravating an already serious shortage of rental spaces. As rental vacancy rates approach zero percent, properties that had secondary suites grandfathered in are now having to be rebuilt according to current zoning, meaning those suites are gone for good.

Alderman John Mar proposed a mass approval of secondary suites to ease the rental crunch, but that proposal was defeated (although, not by much); it is sure to be raised again in the lead up to this fall’s municipal election. The City, since 2009, has been offering homeowners in appropriately zoned areas grant money to create secondary suites, handing out $9 million in three years. Including illegal dwellings, there are well over 60,000 secondary suites in Calgary.

Some people love secondary suites: they’re a great way to generate income from a property, and provide quality accommodations for quiet students and working singles. Others cite traffic concerns and a loss of ‘community feeling’ when more renters enter a neighbourhood. How do you feel? Has the flood, and its fallout, made you more agreeable to having secondary suites permitted where you live?

Tags: basement suites, calgary alberta real estate, calgary flood, calgary real estate, calgary rental property, flooded suites, grant money, illegal suites, john mar, secondary suites

Posted in Industry, News | Comments Off on Flooded Basement Suites

Monday, July 15th, 2013

The Calgary Herald, whose paywall experiment seems to have gone away, reports today that there’re more houses being sold and bought than you can shake a stick at, despite July traditionally being a slower month, what with the Stampede taking everyone’s time (and speaking of Stampede: bacon-wrapped corn dog. That is all). The Herald uses the word ‘deluge’ to describe the rush of buyers looking to enter the market or move somewhere not described as a flood plain.

I’ve never been one to complain about having too much work, despite it elbowing its way into my personal life more and more (I continued negotiations on two offers during an intermission at Stage West not long ago) and leading to a highly irregular meal schedule, so this is great news for me. I’m still camping with the family (mobile Internet is a beautiful thing for telecommuting from the mountains), still enjoyed some Stampede shenanigans, and still managed to help some great families find great homes. This pace won’t continue forever, so right now I say, “bring it on!”.

Tags: bacon wrapped corn dog, buy house, calgary flood, Calgary Herald, calgary housing market, calgary housing stats, Calgary Stampede, homebuyers in Alberta

Posted in Industry, Statistics | Comments Off on More Fast Food, Less Time Watching Breaking Bad, for Calgary Realtors

Thursday, June 20th, 2013

Alright, maybe not ever, but it’s pretty good; from Monday’s Financial Post: “Prices remain stable, perhaps maddeningly so for the legions of bubble mongers,” said Douglas Porter, chief economist at BMO Capital Markets.

Yes, thanks to some new data from the Canadian Real Estate Association, there seems to be a turn in public opinion as to whether or not Canada’s in the midst of a housing bubble. More rational discourse has replaced the nearly-apocalyptic cries of some who still expected our country’s real estate market to follow the United States’ lead into a precipitous plunge.

Instead, we’re seeing healthier-than-expected growth, not just in Alberta, but nationwide. With a new Bank of Canada governor being installed, there’s the possibility of some minor policy shifts from the rockstar tenure (at least by banking standards) of outgoing governor Mark Carney, but I doubt any drastic moves will be made. They just don’t need to be. Household debt is a perennial problem, sure, but it’s not aggravated by an appetite for increasingly expensive homes; by and large, Canadians don’t especially care for being house poor.

I’m certain Alberta will continue to lead the country in home sales and rising property values, as we stand to be Canada’s turbocharged economic engine for some time to come, but it’s nice to see the rising tide lifting all of the ships, to mix some metaphors (unless the turbocharged engine was on a speedboat… Yeah, that’s it!).

Tags: alberta housing market, alberta real estate, bank of canada, BMO capital markets, calgary housing market, calgary real estate, canadian housing market, Canadian Real Estate Association, Douglas Porter, Financial Post, mark carney, rising property value

Posted in Forecasts, Industry | Comments Off on Best Quote Ever

Thursday, May 23rd, 2013

It’s nice to see that, notwithstanding the record-high prices and country-leading growth Calgary’s real estate market has been enjoying, it remains among the most affordable markets in the country.

“Well, that’s weird,” you say. “How could a highly-valued market also be an affordable one?” Easy: despite some revenue dips, Alberta’s still rocking and rolling on the economy front. Our version of a ‘tough times’ budget would be welcomed with open arms in many other provinces, especially Ontario and BC, which are the two other biggest provinces for real estate sales. In the article cited above, RBC’s Affordability Index listed bungalows in Calgary at requiring just under 39 percent of an average household’s pre-tax income; in BC, that number is 82 percent.

Many of us make good money for honest work in Alberta, and we like to put it into our homes. Fortunately a middle class family here can afford to do that without having to live on just 18 percent of our gross. That kind of Alberta Advantage helps to make up for snow in May, doesn’t it?

Tags: Alberta Advantage, calgary alberta real estate, calgary real estate, calgary real estate market, RBC Affordability Index, record-high prices, relative affordability

Posted in Industry, Statistics | Comments Off on Relative Affordability

Monday, April 29th, 2013

There’s been some talk lately about why Calgary’s market isn’t booming like it did in 2006-07, when our employment and population growth is similarly exceptional now. While there may be some truth to self-proclaimed experts’ notions that homebuyers are a bit more cautious than they used to be, and that stricter mortgage rules are proving to be a greater barrier to entry in the market, the fact is that I have more listings right now than I have at any one time in my career, and things show no sign of easing up; I’d better go buy some more key boxes. House prices in Calgary are growing at three times the national average (and our commercial real estate market is performing better than anywhere else in the world). This is the best place to be selling a home in the country (and not only because my dad and I work here).

Of course, enthusiasm must be tempered, both to maintain a little perspective and to add a little variety to newspaper articles. But the fact is we are in a great, enviable position right now with a market that’s growing at a healthy and sustainable pace, and that looks to continue on the same path for the foreseeable future. The bidding wars we were seeing a few years ago aren’t nearly as common, yet houses aren’t sitting on the market for months at a time either; buyers are motivated but not bloodthirsty. This is a good thing. Give me a steady upward march over boom-and-bust craziness any day of the week.

Tags: boom-bust, calgary alberta real estate, calgary growth, Calgary Herald, calgary housing market, calgary housing prices, calgary housing stats, calgary real estate, calgary real estate statistics, house prices, Real Estate News

Posted in Industry, Statistics | Comments Off on Healthy Growth Trumps a Boom

Thursday, April 4th, 2013

I mentioned this in a previous post, but it bears repeating: the Alberta government is seeking public input on ways the Condominium Property Act can be improved through a survey available until May 2. As was discussed in the Calgary Herald on Tuesday, plenty of people have had less than stellar experiences with condo boards, builders, contractors, and the like (although many, many more have never had a problem with their condo or condo board), and there may be ways the Condominium Property Act can be updated to better reflect current realities. It’s been 13 years since the Act was last revised; in that time, tens of thousands of units have been built and their average price has tripled. Our market’s not the same as it was in Y2K – help the government figure out what’s changed, and make things better for buyers, sellers, and builders alike.

Tags: calgary alberta real estate, calgary condo, Calgary Herald, calgary real estate, condo documents, Condominium Property Act

Posted in Industry | Comments Off on Condo Act Revisited

Thursday, March 21st, 2013

So this was unusual: Finance Minister Jim Flaherty apparently convinced Manulife Bank to reconsider a rate cut the institution had put in place, citing concerns about consumer debt levels. Manulife had just posted a five-year fixed rate mortgage at 2.89 percent when Mr. Flaherty’s office called the bank with a message that such a move would be “unacceptable.” Two weeks ago, BMO received a similar warning after posting a 2.99 percent five-year fixed rate; that bank, however, decided against rolling back.

While very good, these rates are certainly not unheard of in the broader market.

This type of basically unprecedented intervention is concerning and problematic, even if you can see where the government is coming from. Unlike in Calgary’s market, real estate sales are down significantly in the rest of the country, but prices aren’t yet dropping a commensurate amount. That means those who are looking to buy a home are still paying big prices, and some are taking on large mortgages to cover the costs. Should the market continue to stagnate, prices will inevitably go down and a segment of those new buyers may end up underwater. Flaherty has already made stricter rules around qualifying for mortgages with less than 20 percent down (meaning, those that require insurance through CMHC) four times in recent years, and has now, it seems, taken to pressuring private lenders directly.

At the end of the day, though, banks should – and still do – have the right to set their rates as they see fit, competing for, in some places, a shrinking pool of buyers. The meltdown in the US was a cautionary tale, but our financial system is a far cry from being as corrupted as that one was, and while house prices have room to go down, panic that we’re on the cusp of a bursting bubble is, in my opinion, somewhat misplaced. Limit CMHC-backed mortgages to 25-year amortizations? Sure, sounds reasonable, and limits the government’s exposure. But let the lenders do their thing.

Tags: alberta real estate, calgary alberta real estate, calgary real estate, Calgary’s real estate market, CMHC, CMHC mortgages, consumer debt levels, Finance minister, finance minister jim flaherty, Jim Flaherty, manulife bank, mortgage rate cut

Posted in Industry, News | Comments Off on Intervention

Monday, March 11th, 2013

I’ve been talking a lot in this space about how Calgary’s housing market is outperforming all comers; well, here’s more proof: we broke a record in February for the highest average selling price for single family homes. The figure, $518,452, comes in a little over two percent higher than the previous record set in 2007 (also known as Calgary’s most recent boom). Now, of course there are extenuating factors coming into play here – notably the fact that the all-time most expensive home sale in the city’s history closed last month, as did a record number of other $1 million plus sales – so CREB’s benchmark numbers are maybe a little more useful when determining what the average Calgarian entering the market is looking at. Those put the typical single-family home at about $440,000, which is still close to $90,000 more than January’s national average.

So is Calgary’s market on-track to price itself out of reach for the average young family looking for a starter home? I don’t think so. The vast diversity of neighbourhoods – and their proximity to downtown – available to residents ensures there’s a price point for everyone, and as Mayor Nenshi wrote in the Herald last weekend, more than 22 square kilometres of serviced land are available for new development, enough to house hundreds of thousands of people at fair prices.

This has already been a banner year for me, and it’s only March; the proverbial sun is shining, so I’m making some hay. I did, however, find the time to add some new functionality to our website: our new, free Market Report tool allows you to see your neighbourhood’s detailed sales history, including addresses and prices. Check it out!

Tags: calgary alberta real estate, Calgary Herald, calgary housing market, calgary real estate, Calgary Real Estate Board, calgary real estate statistics, CREB, market report, mayor nenshi

Posted in Industry, News, Statistics | Comments Off on Breaking Records