April 1st, 2013 by Ryan Shandruk

Painting your home is the do-it-yourself renovation that carries perhaps the biggest bang for your buck – not just come resale time, but in terms of adding to your overall enjoyment of your living spaces. Whether it’s developing a unified scheme that pulls together the decor, designating a boldly coloured feature wall to jazz things up, or simply putting up a fresh coat of whatever’s on there already, you can make your home feel like new for a relatively small investment in both time and money. There are a few considerations, however, that might not be immediately obvious.

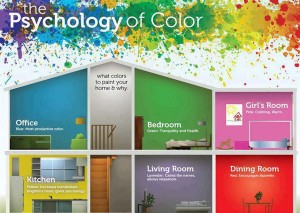

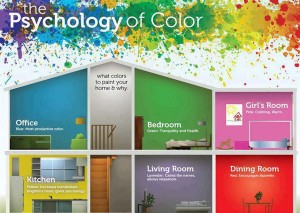

First, think about the mood and energy level implications of the colours you choose. There’s plenty of information on online that can help you make your rooms’ colours match their purposes, so do your research. Orange, for example, is a cheery, energizing choice that might, at first, seem perfect for your kids’ bedroom; at bedtime, though, the last thing you need is something giving the youngsters extra energy. Maybe green – a tranquil, calm colour – would be a better choice, and save the orange for a play area.

Another consideration is the way people will look in a space painted a certain colour. A light green theme throughout a home, for example, may look beautiful, but might also make guests look perpetually unwell thanks to the light reflecting from the walls, so use moderation.

Finally, remember that rich shades of dark colours could need many, many coats of both tinted primer and paint to achieve the desired effect, and if you ever want to go back to something significantly lighter, it’ll be even more work.

If you have the means, interior designers can be a great asset for ensuring your newly painted home is everything you want it to be, and that you don’t put tones side-by-side that’ll drive you slowly crazy. On your own, though, you can still get great, satisfying results with a little forethought and planning.

Tags: choosing paint, choosing paint colour, do-it-yourself reno, home renovation, painting, painting your home, re-painting house, re-painting to sell

Posted in Advice | Comments Off on Colour Consideration

March 29th, 2013 by Ryan Shandruk

#1 Sheep River Heights in Okotoks Alberta. This is a Court Ordered Sale. Please do not enter the property. The listing Realtor has not been able to gain access. Interior inspection is not possible at this time. All information obtained has been by visual street side inspection and tax records with the assumption that the interior has 3 bedrooms, 2.5 baths and a developed walkout basement.

For full listing details visit our webpage.

Tags: alberta real estate, foothills mls, foothills mls listing, MLS, mls listings, Okotoks house, okotoks mls, okotoks mls listing, Okotoks real estate, Sheep River house, Sheep River real estate

Posted in Listings | Comments Off on New Listing – Sheep River 2 Storey

March 28th, 2013 by Ryan Shandruk

This comes as no surprise for me! The latest CTV news article, Decrease in listings increases demand for Calgary homes, outlines some of the reasons why this year is proving to be a hot one for real estate sales. There are nearly 20 percent less home listed compared to the same time last year, which is driving prices upwards and days on market downwards.

As our city sprawls out there is also increasing demand for inner-city property. The Calgary Herald recent posted an article stating that inner-city neighbourhoods saw an increase of 250-260% between 2000-2012.

If you want to take advantage of this market contact me today!

Fill in our free Market Report request to receive monthly email reports detailing all the sales in your neighbourhood, including photos & addresses.

Tags: calgary alberta real estate, Calgary Herald, calgary homes, calgary housing market, calgary housing stats, calgary real estate, Calgary Real Estate Board, calgary real estate statistics, CREB, CTV news, inner-city, inner-city neighbourhood

Posted in News, Statistics | Comments Off on Increased Demand for Calgary Homes

March 22nd, 2013 by Ryan Shandruk

What a great place to live! Country living mere minutes from Okotoks. Over 5 acres of fully fenced land. Many, many trees line the property, the driveway, and are interspersed throughout. There’s also a large vegetable garden. Walk-out bungalow has views of the land from anywhere in the house. Very functional and open floor plan. The cook’s kitchen has new stainless steel appliances throughout including built-in ovens, a walk-in pantry, and a large west deck with a gas line for your BBQ or heater. There’s a massive multipurpose laundry/mud-room leading from the garage. What a garage too; over 1000 square feet of over-sized, four-car, heated man-cave. Full walk-out basement has high ceilings and is partially finished and drywalled with a 4-piece bathroom, a den and rec-room (or 4th and/or 5th bedrooms), and a huge family room. Also included: all TVs attached to the walls, wine fridge, and enough laminate flooring to finish the lower level.

For full listing details, more photos, floorplan and virtual tour visit our web page !

Tags: Acreage bungalow, alberta real estate, calgary acreage, calgary alberta real estate, calgary mls listing, foothills acreage, foothills mls, foothills mls listing, MD of Foothills, MLS, mls listings, okotoks acreage, okotoks mls, okotoks mls listing, Okotoks real estate

Posted in Listings | Comments Off on New Listing – Acreage in M.D. of Foothills

March 21st, 2013 by Ryan Shandruk

So this was unusual: Finance Minister Jim Flaherty apparently convinced Manulife Bank to reconsider a rate cut the institution had put in place, citing concerns about consumer debt levels. Manulife had just posted a five-year fixed rate mortgage at 2.89 percent when Mr. Flaherty’s office called the bank with a message that such a move would be “unacceptable.” Two weeks ago, BMO received a similar warning after posting a 2.99 percent five-year fixed rate; that bank, however, decided against rolling back.

While very good, these rates are certainly not unheard of in the broader market.

This type of basically unprecedented intervention is concerning and problematic, even if you can see where the government is coming from. Unlike in Calgary’s market, real estate sales are down significantly in the rest of the country, but prices aren’t yet dropping a commensurate amount. That means those who are looking to buy a home are still paying big prices, and some are taking on large mortgages to cover the costs. Should the market continue to stagnate, prices will inevitably go down and a segment of those new buyers may end up underwater. Flaherty has already made stricter rules around qualifying for mortgages with less than 20 percent down (meaning, those that require insurance through CMHC) four times in recent years, and has now, it seems, taken to pressuring private lenders directly.

At the end of the day, though, banks should – and still do – have the right to set their rates as they see fit, competing for, in some places, a shrinking pool of buyers. The meltdown in the US was a cautionary tale, but our financial system is a far cry from being as corrupted as that one was, and while house prices have room to go down, panic that we’re on the cusp of a bursting bubble is, in my opinion, somewhat misplaced. Limit CMHC-backed mortgages to 25-year amortizations? Sure, sounds reasonable, and limits the government’s exposure. But let the lenders do their thing.

Tags: alberta real estate, calgary alberta real estate, calgary real estate, Calgary’s real estate market, CMHC, CMHC mortgages, consumer debt levels, Finance minister, finance minister jim flaherty, Jim Flaherty, manulife bank, mortgage rate cut

Posted in Industry, News | Comments Off on Intervention

March 16th, 2013 by Ryan Shandruk

Original owner home. Clean, neat and ready to sell. New carpet and new paint. Developed basement with a wet-bar/kitchenette. Dual laundry, one in the main bath upstairs, and one downstairs. Split side entry. Double garage. Landscaped South back yard. In the walk zone for Tuscany School. Act fast, this will sell right away.

View more photos and full listing details on our webpage.

Tags: calgary alberta real estate, calgary investment property, calgary mls listing, calgary real estate, mls listings, tuscany bungalow, tuscany drive, tuscany home, tuscany house, Tuscany school, tuscany school walk zone, tuscany walk zone

Posted in Listings | Comments Off on New Listing – Tuscany Drive Bungalow

March 15th, 2013 by Ryan Shandruk

According to a just-released Harris/Decima poll, 47 percent of Albertans would take a fixed-rate mortgage if they were applying for one today, as opposed to just 26 percent preferring the variable-rate alternative. That’s pretty close to the national number – 45 percent favouring fixed – and not really that surprising. People tend to like predictability, and are often willing to spend a bit more to get it; the popularity of gas and electricity contracts, in a time when both are pretty inexpensive, is another example of this.

There are plenty of reasons to go fixed, and plenty to go variable. The Globe and Mail reported in December that variable-rate mortgages have been cheaper than their fixed counterparts some 90 percent of the time over the past 25 years, meaning those who rode out market fluctuations came out significantly ahead. On the other hand, right now fixed-rate mortgages are being offered for within one percent of variable rates, meaning the premium paid for stability is lower than it has been in the past.

Ultimately, buyers must make their own decisions based on their immediate circumstances, plans for the future, and tolerance for risk. I know some great experts that can help sort through the choices, and am happy to refer my clients to them, but a hard look at one’s own financial goals is key to setting up a mortgage that won’t lead to any lost sleep.

Tags: calgary alberta real estate, calgary real estate, fixed-rate mortgage, Globe and Mail, harris/decima, variable mortgage, variable-rate mortgage

Posted in Advice, Statistics | Comments Off on Fixed or Variable

March 11th, 2013 by Ryan Shandruk

I’ve been talking a lot in this space about how Calgary’s housing market is outperforming all comers; well, here’s more proof: we broke a record in February for the highest average selling price for single family homes. The figure, $518,452, comes in a little over two percent higher than the previous record set in 2007 (also known as Calgary’s most recent boom). Now, of course there are extenuating factors coming into play here – notably the fact that the all-time most expensive home sale in the city’s history closed last month, as did a record number of other $1 million plus sales – so CREB’s benchmark numbers are maybe a little more useful when determining what the average Calgarian entering the market is looking at. Those put the typical single-family home at about $440,000, which is still close to $90,000 more than January’s national average.

So is Calgary’s market on-track to price itself out of reach for the average young family looking for a starter home? I don’t think so. The vast diversity of neighbourhoods – and their proximity to downtown – available to residents ensures there’s a price point for everyone, and as Mayor Nenshi wrote in the Herald last weekend, more than 22 square kilometres of serviced land are available for new development, enough to house hundreds of thousands of people at fair prices.

This has already been a banner year for me, and it’s only March; the proverbial sun is shining, so I’m making some hay. I did, however, find the time to add some new functionality to our website: our new, free Market Report tool allows you to see your neighbourhood’s detailed sales history, including addresses and prices. Check it out!

Tags: calgary alberta real estate, Calgary Herald, calgary housing market, calgary real estate, Calgary Real Estate Board, calgary real estate statistics, CREB, market report, mayor nenshi

Posted in Industry, News, Statistics | Comments Off on Breaking Records

March 8th, 2013 by Ryan Shandruk

CPS just announced The Hub Messaging System, a community automated notification system.

Get crime info via text message!

Find out right away about crime in your neighbourhood.

Tags: calgary crime, calgary police notification, calgary police service, CPS, Hub Messaging System

Posted in News | Comments Off on Calgary Police Service Messaging System

March 6th, 2013 by Ryan Shandruk

I pay for a professional stager to evaluate nearly every home I represent. Sure, after thirteen years in the business I have a pretty good idea what a property that’s going to move looks like; I don’t necessarily need a second opinion to get most of the way there. Still, I recognize the value of people who are good at what they do, and specialize in their field, and moreover I believe proper staging is one of the most reliable ways to sell a house for at or near asking price.

What does a stager do? Well, the one I use surveys the property and scrutinizes it the way a buyer might, then prepares a detailed report filled with recommendations on how to make the home show better. This might be shifting around some furniture (or getting rid of some), paring down items on shelves, and just general decluttering. A stager is a design professional who knows about the relationship of objects in space, and how that relationship makes people feel. The same way a clever Realtor came up with the idea of baking cookies in a home before an open house to elicit warm fuzzies in potential buyers, a stager helps make a home feel wonderful to visit and therefore attractive to buy. All those fabulous properties on magazine covers, they don’t just look like that naturally – they’re carefully staged to give off a particular vibe: to look larger, warmer, breezier, more modern.

Clients can choose to hire a stager to do the work of staging the house, even to the extent of renting furniture, artwork, and other props to create a unified look (particularly useful in a vacant property). At the very least, though, I usually insist on the consultation, as the relatively small investment of money and time usually translates to a faster sale for a higher price. And we all like that.

Tags: calgary alberta real estate, calgary real estate, design professional, home stager, home staging, professional home staging

Posted in Advice | Comments Off on Staging Matters